alameda county property tax rate

So if you purchase a house that costs 600000 you are required to pay 600 in county transfer taxes. Then question if the size of the increase is worth the time and effort it will take to appeal the assessment.

The Kiplinger Tax Map Guide To State Income Taxes State Sales Taxes Gas Taxes Sin Taxes Gas Tax Healthcare Costs Better Healthcare

Alameda County Property Taxes Payment With Credit Card.

. You can lookup your. How Alameda County property taxes are determined Alameda County comprises 14 different cities with some of the most desirable suburban properties in Californias Bay Area. You wont get a receipt if you mail in your taxes so check your bank statement to see that the check has cleared.

Alameda County Property Taxes Payment With E-check. At this point property owners usually order service of one of the best property tax attorneys in Alameda CA. No fee for an electronic check from your checking or savings account.

The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose. Alameda County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. For tax balances please choose one of the following tax types.

If youre a resident of Alameda County California and you own property your annual property tax bill is probably not your favorite piece of mail. California has a 6 sales tax and Alameda County collects an additional 025 so the minimum sales tax rate in Alameda County is 625 not including any city or special district taxes. 1221 Oak Street Room 131.

The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices. Whether you are already a resident or just considering moving to Alameda County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Look Up Your Property Taxes.

A convenience fee of 25 will be charged for a credit card transaction. The mailing address is. Beside this what is the tax rate in Alameda County.

The median annual property tax payment in Santa Clara County is 6650. We accept Visa MasterCard Discover and American Express. No fee for an electronic check from your checking or savings account.

The property tax rate in the county is 078. The average effective property tax rate in Alameda County is 078. The Alameda County Sales Tax is collected by the merchant on all qualifying sales made.

Information in all areas for Property Taxes. You can pay online by credit card or by electronic check from your checking or savings account. The average effective property tax rate in Alameda County is 079.

Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. If the property is sold lienholders and the former owner may claim proceeds in excess of the taxes and cost of the sale. These exemptions can lower your property tax bills by 100 or up to 1000 depending on the district.

The California state sales tax rate is currently 6. Tax Rate Areas Alameda County 2022. 1221 Oak Street Room 131 Oakland CA 94612.

Total tax rate Property tax. For example property taxes due for the fiscal year July 1 2014 through June 30 2015 are assessed on January 1 2014. The Parcel Viewer is the property of Alameda County and shall be used only for conducting the official business of Alameda County.

View Alameda County Property Tax Bills. Get free info about property tax appraised values tax exemptions and more. This means that every county including Alameda has a rate of 110 per 1000 of the assessed property value.

Alameda County Treasurer-Tax Collector. California citizens can get this 10000 homestead exemption together with the 25000 one that is available to all homeowners. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

For payments made online a convenience fee of 25 will be charged for a credit card transaction. In this state you are also entitled to school parcel tax exemption. This table shows the total sales tax rates for all cities and towns in.

The county tax rate is the same across the state of California. The tax type should appear in the upper left corner of your bill. The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc.

Subsequent year current tax bill and still has the ability to keep the property until the day before the sale by paying taxes in full. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per. 125 12th Street Suite 320 Oakland CA 94607.

510 272-3836 Toll Free. But remember that your property tax dollars pay for needed services like schools roads libraries and fire departments. The minimum combined 2020 sales tax rate for Alameda County California is 925.

2 How to make the Alameda County Property Tax Payment Online. Lots of K-21 districts provide exemptions to. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value.

Bill of Alameda County Property Tax. In Alameda County homeowners end up paying an average of 3993 per year in property taxes. This is the total of state and county sales tax rates.

Alameda County Treasurer-Tax Collector. Pay Your Property Taxes Online. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others.

However the costs dont stop here as some cities in Alameda. The total sales tax rate in any given location can be broken down into state county city and special district rates. Find your actual property tax payment incorporating any exemptions that apply to your real estate.

A valuable alternative data source to the Alameda County CA Property Assessor. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County. Learn all about Alameda County real estate tax.

Select the option to start invoice payments. Single Family Residential Homes Used as Such.

California Public Records Public Records California Public

Pin On How To Invest In Real Estate

Pin On Real Estate Tips For Buyers Sellers

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator With Q Supportive Property Tax Homestead Property

Pin On Open House Flyer Ideas Free

Low Income Apartments With No Waiting List Low Income Apartments Low Income Income

Every County In America Ranked By Scenery And Climate Beautiful Places In America Places In America North America Map

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

2021 Residential Homestead Exemption Homesteading Harris County Real Estate Agent

Chicago Tribune Exposes Screwed Up Cook County Property Tax Assessments Property Tax Tribune Chicago Tribune

Best Erath County Tax Office Motor Vehicle Courthouse Annex Ii In 2022 Courthouse Ukiah Motor Car

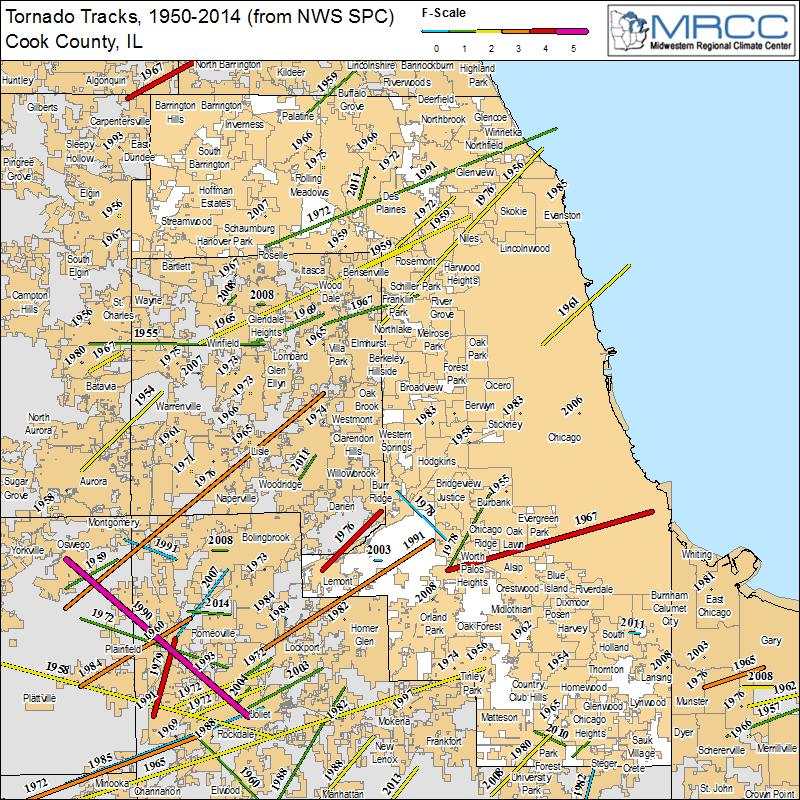

Chicago Tornados Map Tornado Map Map Chicago

Head Designer Eva S Schoolhouse Dining Room Design Farmhouse Dining Room Room Farmhouse Dining

Treasurer Releases Estimate Of Average Property Tax Bill By Township Kane County Connects Property Tax Tax Extension Township